Project Phoenix

High Impact, INFRASTRUCTURE-LED EXPLORATION

Operator | ~75% WI

290 MMBO Unrisked net mean prospective resources1,3

157 MMBOE 2C Net Contingent Resources2,3

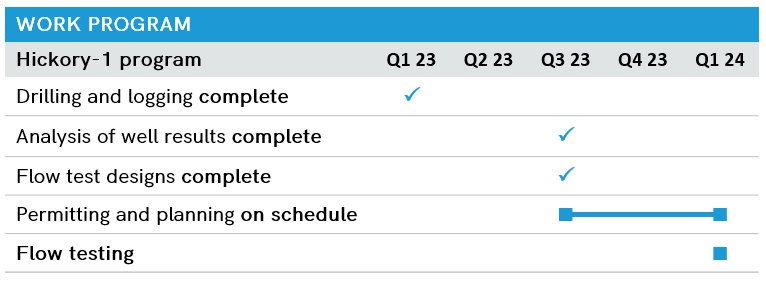

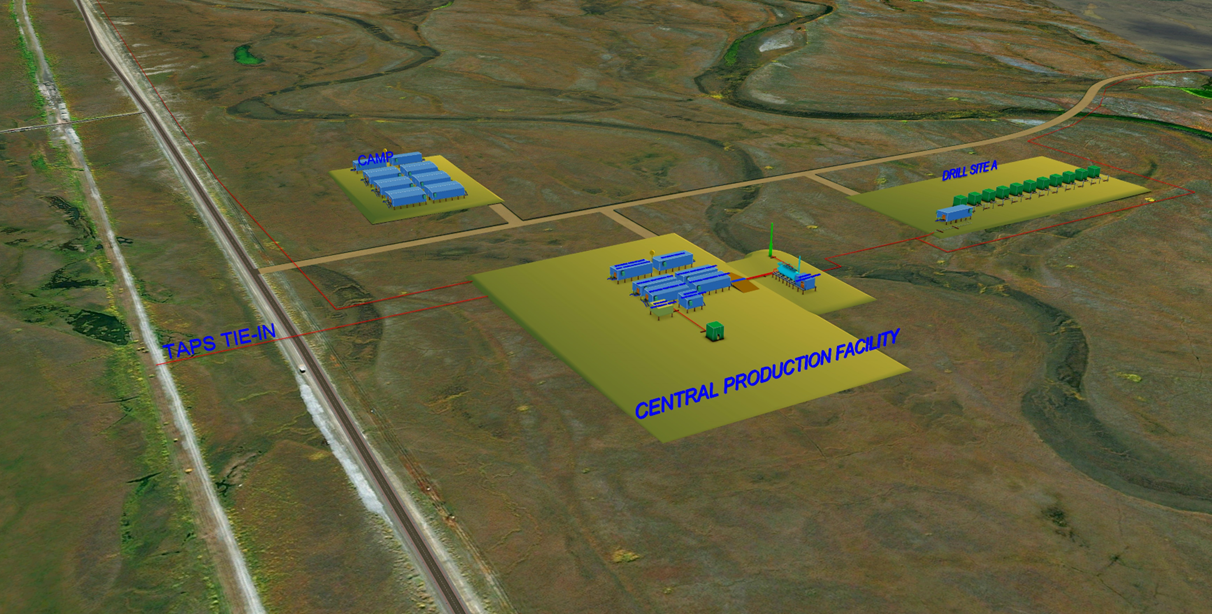

Hickory-1 well spudded March 2023 and drilled to TD of 10,650 feet with successful wireline and coring program completed and the well cased and suspended ahead of flow testing multiple zones in Q1 2024 Alaska winter season.

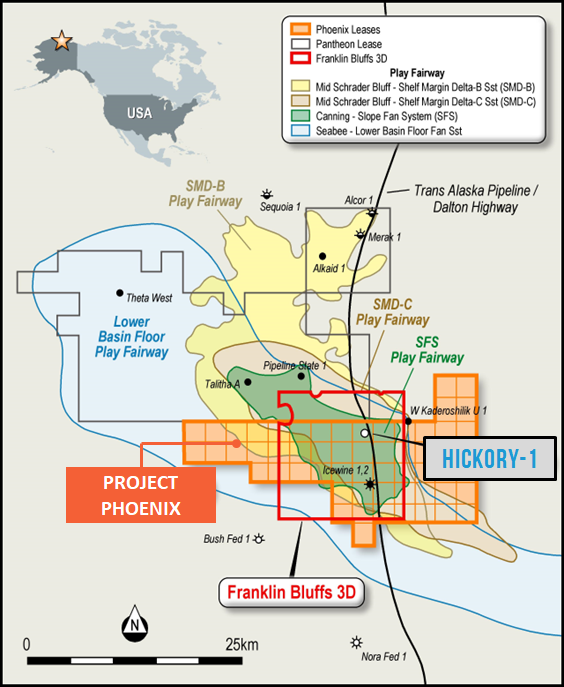

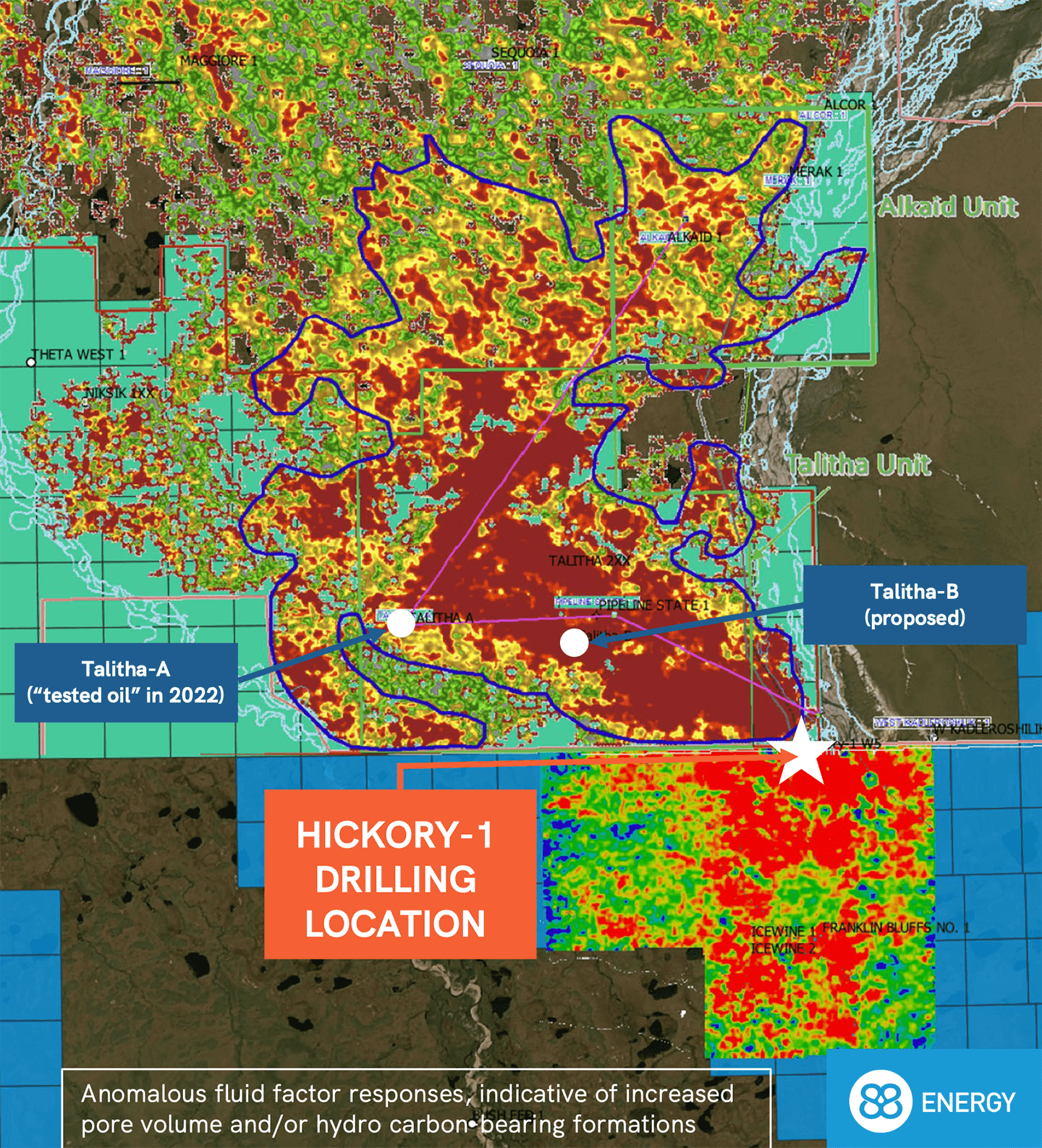

Icewine East was renamed Project Phoenix to reflect the refreshed exploration strategy for this acreage. Since its acquisition in 2014, the acreage targeted the unconventional HRZ play. Project Phoenix is focused on the oil-bearing conventional reservoirs that were identified during the drilling and logging of Icewine 1 and 2 and recent offset drilling. Project Phoenix is strategically located on the Dalton Highway with the Trans-Alaskan Pipeline System running through the Acreage.

PROJECT

PHOENIX

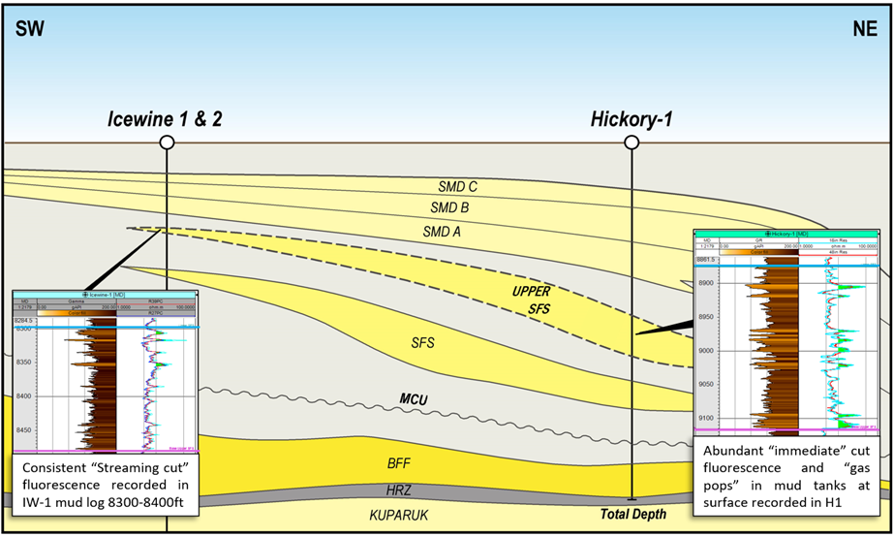

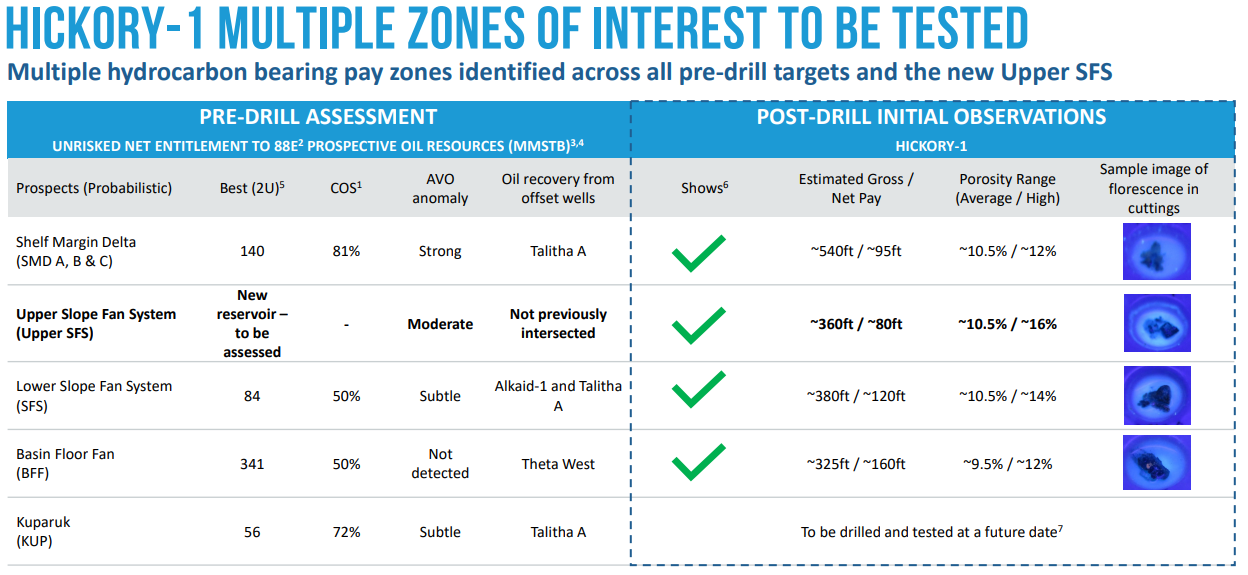

I. petrophysical interpretation confirmed presence of multiple hydrocarbon bearing pay zones across all pre-drill targets, in addition to identification of the new Upper SFS reservoir.

II. Estimated net pay calculated from wireline data of OVER 400 feet ACROSS all pay zones (gross pay estimated to be over 2,000 feet).

III. Average total porosity across all pay zones of 9-12%, including key zones identified for potential testing in the Upper and Lower SFS with between 11-16% total porosity.

IV. Pre-drill expectations met or exceeded on reservoir quality (higher than expected porosity in SFS and BFF) and thickness (higher total gross reservoir, total net reservoir and total net pay).

V. Results compare favourably with analogue field – codell sandstone DJ Basin.

- Situated on the Central North Slope, Alaska and close to existing infrastructure.

- The Company has held the acreage since 2015 and in that time conducted 2 well penetrations, Icewine-1 (2016) and Icewine-2 (2017). Both were designed and drilled to test a deep unconventional play and positive drilling results within the shallower Brookian reservoirs (SMD play) were overlooked due to the different focus of those drilling programs.

- Previously named Icewine East, the renaming to Project Phoenix, reflects the refreshed exploration strategy that focuses on shallow, conventional reservoirs that are proven oil-bearing within adjoining acreage to the North, on correlatable sequences with oil shows in Icewine-1.

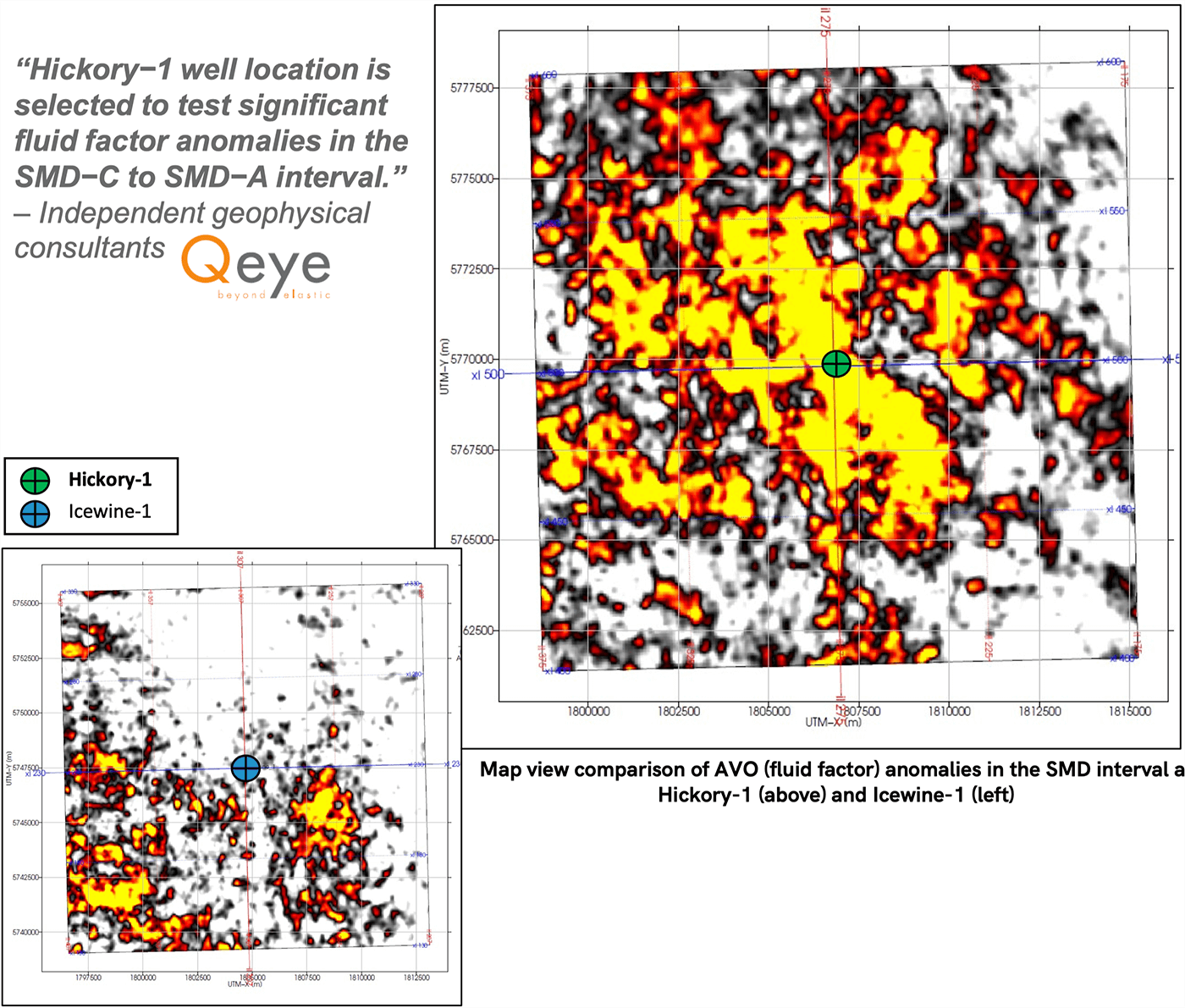

- The project has access to an extensive 2D seismic database that facilitated initial determination of prospective volumes and licensed 225km2 Franklin Bluffs 3D seismic data survey (FB3D) covering the acreage in June 2022.

- Seismic studies of the FB3D, including Amplitude Versus Offset (AVO) analysis and seismic inversion were used to optimise the drilling location of Hickory-1.

Recent mapping of the Upper sfs reservoir collecting to strong shows in Icewine-1 well and multiple hydrocarbon bearing pay zones to be tested in Q1 2024.

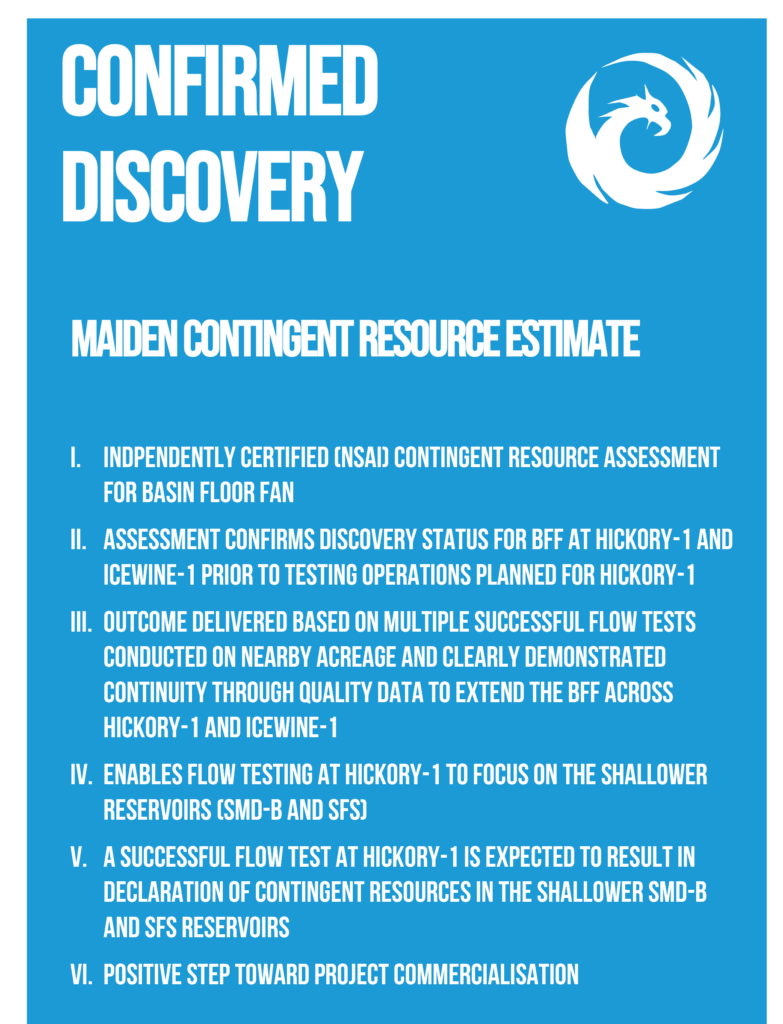

Contingent Resources: Basin Floor Fan Net Entitlement to 88 Energy 4,5

Probabilistic Method Low (1U) Best (2U) High (3U)

Oil Million Barrels 11 28 65

NGL Million Barrels 22 57 137

Oil + NGL Million Barrels 33 85 202

Gas Billion Cubic Feet 160 394 890

Total Million Barrels of Oil equiv. 62 157 364

Managing Director, Ashley Gilbert, commented:

“This maiden, Contingent Resource is a great result for 88E and its shareholders. It represents an important milestone on the path to the possible development of Project Phoenix, even prior to flow testing operations at Hickory-1 this upcoming season….”

4. Net entitlement to 88E is approximately 63%

5. Refer to ASX announcement dated 6 November 2023 for full details with respect to the contingent resource estimate, associated risking and Cautionary Statement on page 3

HIGH IMPACT EXPLORATION WELL

- Spud in March 2023 to TD of 10,650ft

- Validated prescence of Multiple Hydrocarbon-bearing zones across all 6 pre-drill targets

- Obtained quality data to optimally design and plan a 2023/24 winter season flow test

- Identified new Upper SFS Reservoir

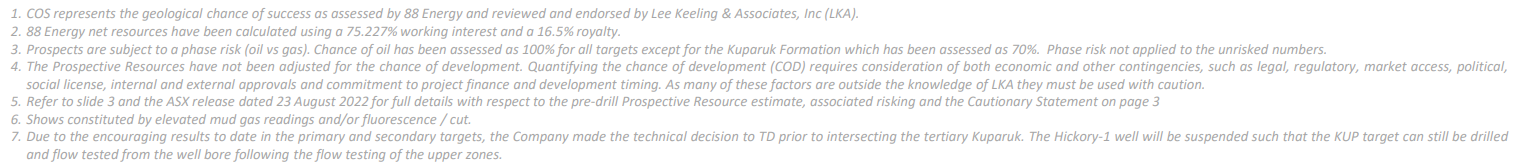

Strategically located near to infrastructure:

- Deadhorse – North Slope services hub

- Adjacent to Dalton Highway and Trans-Alaska pipeline

- Immediate Export Route

- Expediting future development

- Minimising costs and environmental impact

INFRASTRUCTURE LED EXPLORATION

Fast-tracked, cost-effective future commercialisation

Phased development minimises upfront CAPEX

Planned multi-frac long horizontal well development

Scalable model enables development flexibility

Location provides Low-CAPEX future development

Simple TAPS Tie-in enables accelerated commercialisation and sale of oil

Adjacent to Dalton Highway and Proximate to Deadhorse

- Adjacent to 414 mile Dalton Highway, running from Deadhorse in the north to the Elliot Highway in the South provides excellent access to services

- Phoenix acreage is also traversed north to south by the Trans-Alaska Pipeline System (TAPS)

- TAPS is one of the worlds largest pipeline systems, consisting of the trans-Alaska crude oil pipeline, 11 pump stations, several hundred miles of feeder pipelines and the Valdez Marine terminal

- Proximity to TAPS provides immediate export infrastructure minimising development capex and time to commercialisation

Figure 1: The Hickory-1 flow test is planned to assess up to 4 zones

INFORMED BY ANALYSIS OF AN EXTENSIVE DATA SUITE

High quality 2D and 3D Seismic Data interpretation supported by AVO analysis

HICKORY-1 VS ICEWINE-1 AVO ANOMALIES

| NET ENTITLEMENT PROSPECTIVE RESOURCE (MMBO, UNRISKED) | ||||

| Low (1U) | Best(2U) | High (3U) | Mean | |

| Prospects Total | 92 | 280 | 641 | 2901 |

| NET ENTITLEMENT (~63%) CONTINGENT RESOURCES2 | |||

| Low (1C) | Best(2C) | High (3C) | |

| TOTAL MILLION BARRELS OF OIL EQUIVILANT | 62 | 157 | 364 |

- Pre-drilling net entitlement to 88E. Refer to the ASX release dated 23 August 2022 and also 6 November 2023 for full details with respect to the Prospective Resource estimate, associated risking and Cautionary Statement below.

- Post-drilling net entitlement to o 88E associated with the Basin Floor Fan reservoir. Refer to the ASX release dated 6 November 2023 for full details with respect to the BFF Contingent Resource estimate.

- Cautionary Statement: The estimated quantities of petroleum that may be potentially recovered by the application of a future development project relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially movable hydrocarbons.

Hickory-1 well spud in March 2023 targeting 647 MMBO 1,2 Moves to flow testing

“The results have confirmed or exceeded our pre-drill expectations and identified the new Upper SFS reservoir. We HAVE commenced planning and permitting for the next phase of operations at Hickory-1: scheduled flow testing in the 2023/24 winter operational season in Alaska”.

Ashley Gilbert, Managing Director