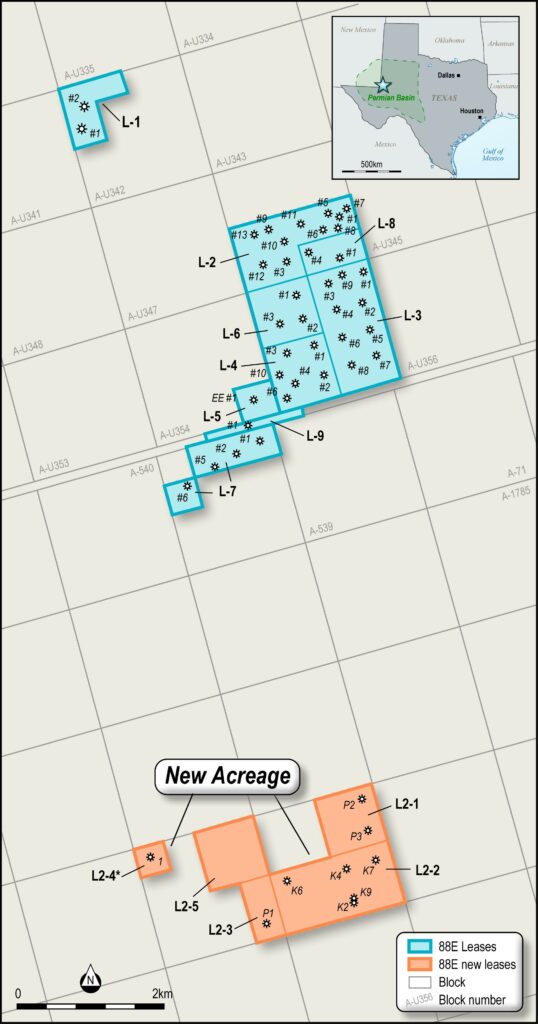

Project Longhorn

STEADY PRODUCTION TO SUPPORT ALASKA LEASES AND TECHNICAL RESOURCES

Non-Operator | ~73% WI

3 MMBO 2P Net Reserves to 88E Revenue Entitlement1,2,3

40 Producing Wells (8 within newly acquired acreage)

- Low-cost Entry with NET 2P Reserves of 3 MMBOE

- Solid PDP Production with Workover and new drill upside

- 6 work-overs successfully completed in 2022 delivering increased production since acquistion

- Production of ~360BOE/pd (~70% oil)4

- 5 work-overs and 14 new drill targets remain on the acreage5

| GROSS RESERVES (MMBOE) | NET RESERVES (MMBOE) | |||||

| 1P | 2P | 3P | 1P | 2P | 3P | |

| Bighorn Phase 11 | 2.54 | 3.08 | 3.95 | 1.52 | 1.84 | 2.36 |

| Bighorn Phase 22 | 2.25 | 2.74 | 3.37 | 0.97 | 1.14 | 1.35 |

1. Refer to 31 December 2022 Annual Report for latest reserves and ASX announcement 21 February 2022 announcing the acquisition of Project Longhorn assets and initial reserves estimates and assumptions.

2. Refer to ASX announcement 3 July 2023 announcing the acquisition of additional Texas oil and gas production assets.

3. Cautionary Statement: The estimated quantities of petroleum that may be potentially recovered by the application of a future development project relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially movable hydrocarbons.

4. Based on Operator and internal reports and forecasts.

5. Subject to AFE and JV approvals.