Project Longhorn

Project Longhorn

THE ACQUISITION OF PROJECT LONGHORN

The acquisition of Project Longhorn represents 88 Energy’s first move into producing oil and gas assets and is in line with the Company’s strategy to build a successful exploration and production company.

This step has been undertaken in a measured fashion via the purchase of a non-operated working interest with a single basin focus. Project Longhorn contains well understood geology with low technical risk and provides near-term upside via low-cost field development opportunities.

PROJECT LONGHORN

Non-operator with ~73% ownership interest1

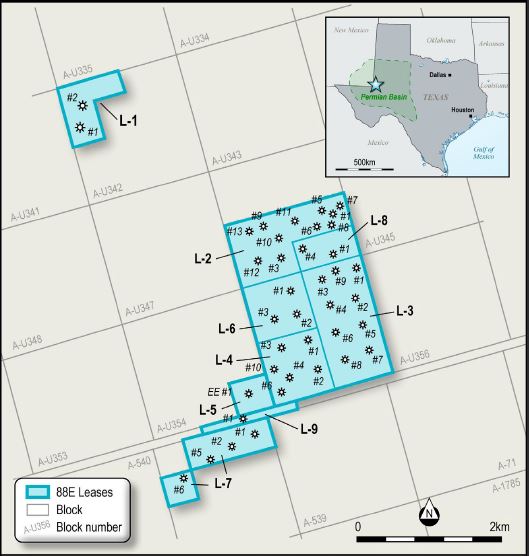

- The oil and gas production assets, collectively known as Project Longhorn, are located in the attractive Permian Basin and contain independently certified net 2P reserves of 2.1MMBOE

- Appox. 1,300 net acres in West Andrews and Ector Countries

- Initial production of 300 BOE per day gross from 32 producing wells

- Seven low-cost work-overs are planned in 2022, target (2P) doubling of current output by end of CY2022

- Target further eleven work-overs or new drills anticipated to increase production to circa 1,300 BOE per day (2P) at program completion

- Strong results from three of seven completed workovers, has increased production by over 70% from acquisition levels. Production from the Longhorn wells exceeded 650 BOE per day gross (over ~475 BOE per day net, approximately 70% oil) following completion of the third work-over at the end of May, at initial production rates. Daily production rates are anticipated to settle at around ~500 BOE per day gross (over ~365 BOE per day net, of which approximately 70% is oil) in July, which represents an overall output increase of ~70% since the completion of the acquisition in mid-February 2022.

- The production increase provides additional direct exposure to the higher WTI oil and gas price environment and accelerates payback on both the acquisition of the assets and the capital investment in the work-overs

- Given the success of the initial three work-overs, as well as the continued high oil and gas price environment, the joint venture participants have agreed to accelerate the capital development program and the completion of the remaining four planned work-overs

- Project Longhorn is now scheduled to complete the targeted seven capital development activities earlier than planned in Q4 2022

"Delivering immediate output and near-term production drilling upside”

Ashley Gilbert, Managing Director

TRANSACTION HIGHLIGHTS

- Diversifying Portfolio with Production

- Low-cost Entry with NET 2P Reserves of 2.1 MMBOE

- Attractive Location in Texas, USA

- Solid PDP Production with Low-Risk Upside

| LONGHORN RESERVES – PHASE 2 | GROSS1 | NET ENTITLEMENT1 | |||||

| 1P | 2P | 3P | 1P | 2P | 3P | ||

| OIL | MMBO | 1.44 | 1.71 | 2.05 | 0.85 | 1.01 | 1.20 |

| GAS | BCF | 4.97 | 6.16 | 6.96 | 2.93 | 3.64 | 4.06 |

| NGL | MMBO | 0.51 | 0.72 | 0.79 | 0.30 | 0.43 | 0.46 |

| TOTAL RESERVES | MMBOE | 2.78 | 3.46 | 4.00 | 1.64 | 2.05 | 2.33 |

|---|---|---|---|---|---|---|---|

Note – 1. Please refer to the ASX release dated 18 February 2022 for full details with respect to the independent Reserves Estimates, associated risking and applicable Cautionary Statement on page 2.

PROJECT MAP