Project Leonis

STRONG EXISTING DATA SUITE INCLUDING > 200FT LOGGED NET PAY & CLOSE TO INFRASTRUCTURE

Operator | 100% WI ~26k acres (10 leases)

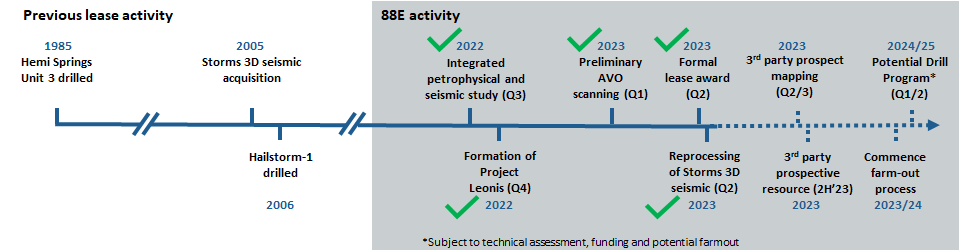

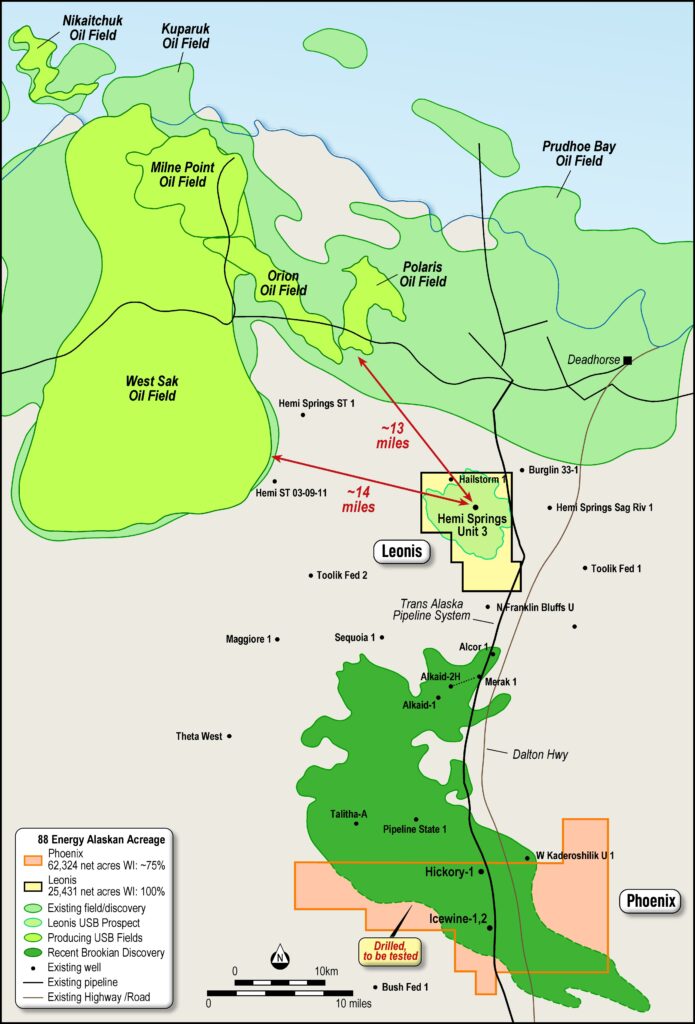

In November 2022, 88 Energy was the highest bidder on 10 leases covering approximately 25,600 contiguous acres immediately south of Prudhoe Bay on the North Slope of Alaska with formal award in April 2023.

The acreage, referred to as Project Leonis, is covered by the existing Storms 3D seismic data suite and contains the historical exploration well Hemi Springs Unit #3 (drilled by ARCO in 1985).

Project Leonis is superbly located adjacent to TAPS and the Dalton Highway, enhancing future potential development commercialisation.

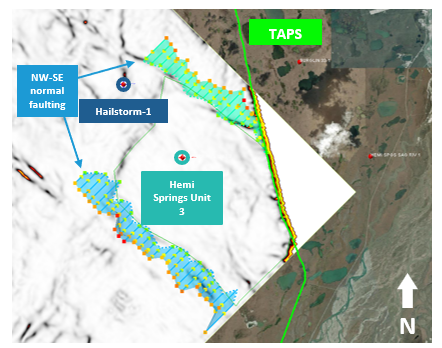

Preliminary interpretation of modern Storms 3D seismic identified that the Upper Schrader Bluff (USB) reservoir penetrated by Hemi Springs Unit 3 is isolated from other wells in the vicinity.

The USB reservoir is a producing unit to the North (including the West Sak and Polaris fields, amongst others).

Hemi Springs 3 reported “oil over shakers” at multiple depths; it was later abandoned when deeper primary targets were not correspondent with oil shows.

88E’s active preliminary data examination has calculated over 200 ft of net pay in the USB reservoir using modern log analysis techniques.

IMMEDIATELY SOUTH OF PRUDOE BAY (Proven petroleum province)

- Including UPPER SCHRADER BLUFF (USB) Reservoir.

STRONG EXISTING DATA SUITE

- Hemi Springs Unit 3 well drilled in 1985

- Hailstorm-1 well drilled in 2006

- In 2022, acquired modern Storms 3D Seismic shot in 2005

- Reprocessed the Storms 3D in 2023.

INITIAL STORMS 3D SEISMIC INTERPRETATION IDENTIFIED USB PENETRATED BY HEMI SPRINGS 3

- USB reservoir is a producing unit to the North (West Sak and Polaris Fields).

HEMI SPRINGS 3 REPORTED “OIL OVER SHAKERS” AT MULTIPLE DEPTHS

- Deeper targets were the focus in 1985.

88E Preliminary data review calculated > 200ft of logged net pay in the USB reservoir

- Importantly this was using Modern log analysis techniques not available in 1985.

Figure: Time slice of Edge Detection attribute run on the Storms 3D seismic. Edge detection attribute clearly shows NW-SE normal faulting as well as a NE-SW feature which separates the reservoir at Hemi Springs Unit 3 from that of nearby Hailstorm-1.